Hi all,

Blockchains in general and cryptocurrencies in particular don’t have a really good reputation. The most recent crypto boom lasted until about November 2021. Since then, it has been complicated to say the least.

Even for those who have no idea what a cryptocurrency even is, FTX became something to talk about when the company went from saviour of the industry to completely bankrupt in the space of a few weeks.

This level of attention meant that crypto even got its own chapter in the annual “Economic Report of the President” – for the very first time. Just a few weeks before the trial against FTX founder Sam Bankman-Fried starts, we’re looking back at the report.

So what’s up?

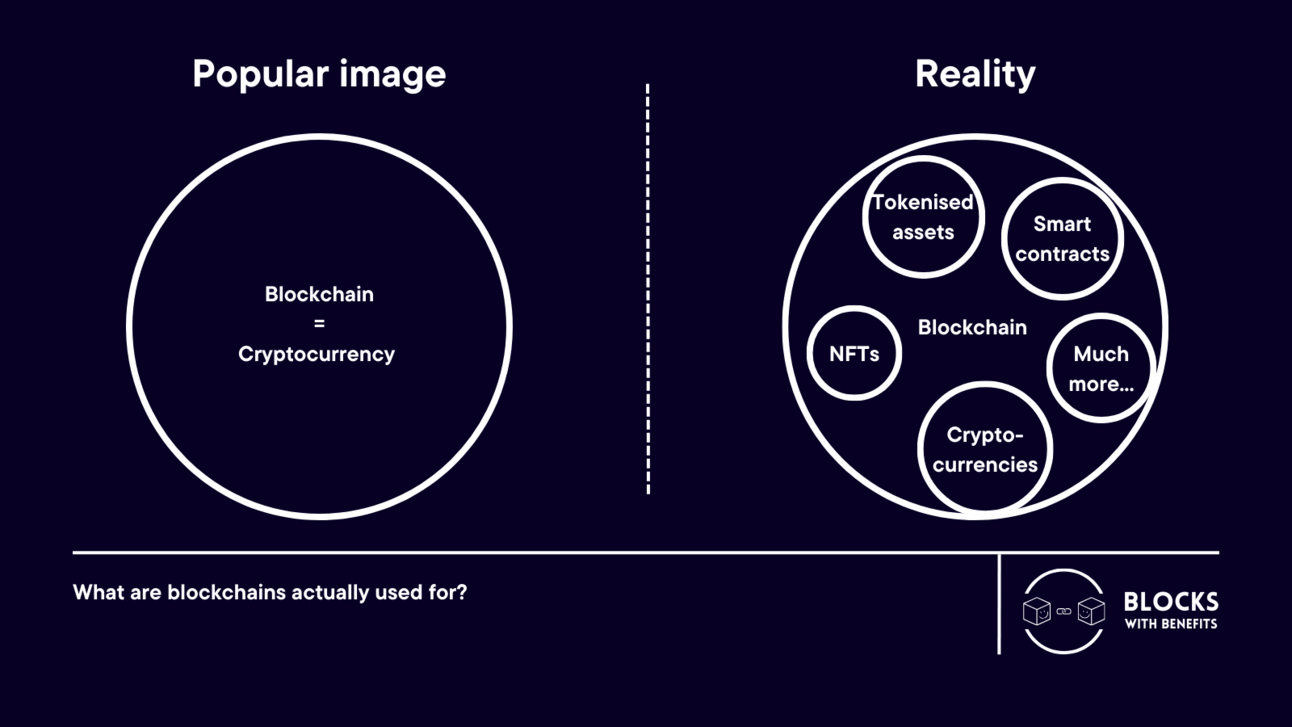

It’s safe to say that many of Joe Biden’s advisors don’t think much of cryptocurrencies. Moreover, they are using terms like “blockchain” and “cryptocurrency” almost as synonyms. That just highlights the need for better education once again. Today, we’re looking at:

The ongoing debate

The alleged lack of practical use cases

The broader picture

Let’s get started! 🤓

Are blockchains actually useful or just a waste of computing power?

If you read the 2023 Economic Report of the President, you will get the idea that Joe Biden's advisors really believe the latter.

Among many other things, the report – which was published in March – includes a chapter that looks at digital assets and the technology in the background, albeit with a focus on crypto assets. The fact that even the headline ('Relearning Economic Principles') is somewhat patronising is unlikely to be coincidence.

The debate

The chapter starts with some valid points. It states that crypto assets to date are not 'an effective alternative to fiat money, improve financial inclusion, or make payments more efficient'. The authors then acknowledge that experiments with blockchain technology – both by the public and private sector – may help to realise the potential benefits.

Aside from the most ardent supporters of cryptocurrencies, this summary is something that most mainstream politicians (both inside and outside the United States) would probably agree with.

Very few of them, however, would argue against 'blockchain' and 'cryptocurrency' being used more or less as synonyms, even though that is one of the main shortcomings of the entire chapter.

It assesses some claims about 'crypto assets' (e.g. that they could be investment vehicles or enable fast digital payments), but only to the extent that they can be dismissed. While many of the arguments may actually be relevant, they are somewhat outdated.

That's unfortunate at best in discussions about technology-related matters.

More importantly though, the report makes virtually no distinction between crypto assets and 'distributed ledger technology' as blockchains are referred to. For a contribution largely aimed at ensuring that cryptocurrencies are kept separate from the 'mainstream' financial system, that makes sense. From a technical standpoint, it doesn't.

Lack of practical use cases?

The authors' main takeaway is that blockchain technology has 'demonstrated only limited, if any, economic benefits so far'. They even look at three use cases: Walmart Canada's attempt to incorporate blockchain technology in the company's supply chain, NFTs and virtual real estate as well as Helium, the decentralised wireless network.

At this point, it's useful to look at those aspects that are not mentioned:

Differences between public and private blockchains

The concept of the so-called smart contracts, i.e. programmes which are automatically executed when certain pre-defined preconditions have been met

Tokenization of real-world assets which allows them to be easily transferred

Several other points could be listed as well. However, it is pretty obvious that the authors didn't want to highlight the actual potential of blockchain technology.

The broader picture

So why bother to include this entire chapter at all? It's helpful to look at the broader picture. The Economic Report of the President is an annual report. It usually reviews economic activity in the previous year and outlines goals for the months ahead. In 2022, crypto markets made headlines for all the wrong reasons, highlighted by the demise of the cryptocurrency exchange FTX and the subsequent arrest of its founder Sam Bankman-Fried.

Prior to 2022, crypto markets had been largely irrelevant for the broader economy. In 2022, however, significant numbers of retail investors were affected, leading to calls for better regulation. Political attention therefore shifted towards the industry, particularly – but not limited to – the United States.

For the US in particular, the fact that digital assets were worth an entire chapter in the most recent Economic Report of the President underlines that these have climbed much higher on the list of political priorities in recent months.

How regulation will eventually look like is currently under debate. By and large, most politicians seem to be concerned with cryptocurrencies rather than the underlying blockchain technology.

We will explore the pros and cons of this approach, as well as the links and differences between them.

Stay tuned and subscribe so that you’ll get our content as soon as it’s ready. (We’ll really try not to be boring.)