On 10 January, the U.S. Securities and Exchange Commission (SEC) approved the first so-called exchange-traded funds (ETFs) that track the price of bitcoin. It sounds like a real game-changer for cryptocurrencies. And it's at least a little bit ironic.

The new ETFs are offered by traditional financial institutions. They will give everybody the opportunity to invest in an asset that was created in response to the global financial crisis and to huge bailouts provided by governments to... traditional financial institutions.

So what’s up?

We'll have a look at why these new ETFs are important for several reasons:

Why buy an ETF instead of bitcoin?

Why are they being launched now?

How do they increase bitcoin demand?

Let’s get started! 🤓

Despite the history of bitcoin as a decentralized cryptocurrency which is not regulated by a central bank, many people in the industry had been trying to launch ETFs for years.

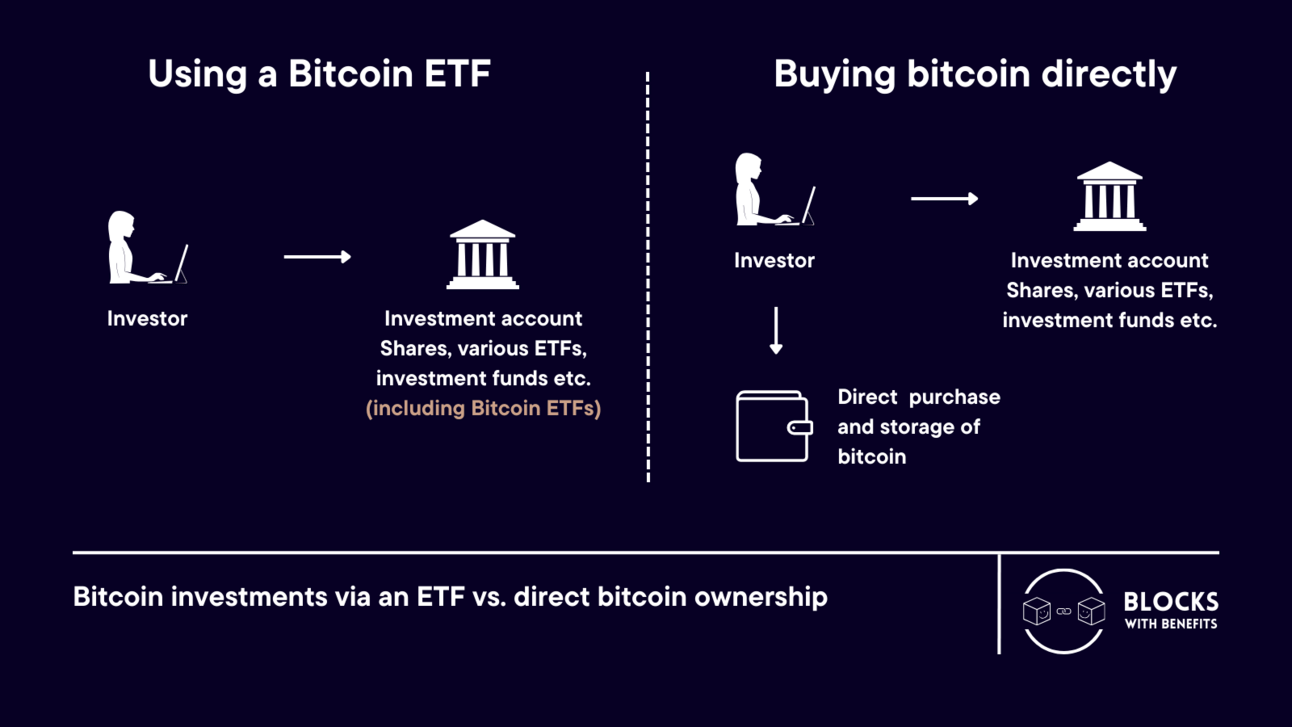

In theory, investors could obviously buy bitcoin directly and avoid the management fees that every ETF is charging. To do that, however, they would have to create their own wallets and accounts with crypto exchanges.

Many crypto exchanges don't have a great track record. While there are notable exceptions, exchanges are often viewed as prone to hacks while providing limited security. Failings of large players like FTX (bankrupt) or Binance (guilty plea about breaking US laws) have not helped the industry's reputation.

Buying ETF shares, on the other hand, allows you to have all your investments in one brokerage account. Moreover, ETFs are listed on regulated stock exchanges. That makes bitcoin even accessible for institutional investors such as pension funds. These are usually not allowed to invest directly into crypto markets.

Is it truly unique – and why now?

The SEC's approval is a first – but only for the United States. Bitcoin ETFs have been traded for a while in Canada and Europe.

Adding the US to the list is significant though. It's the largest capital market in the world, home to some of the globe's largest asset managers.

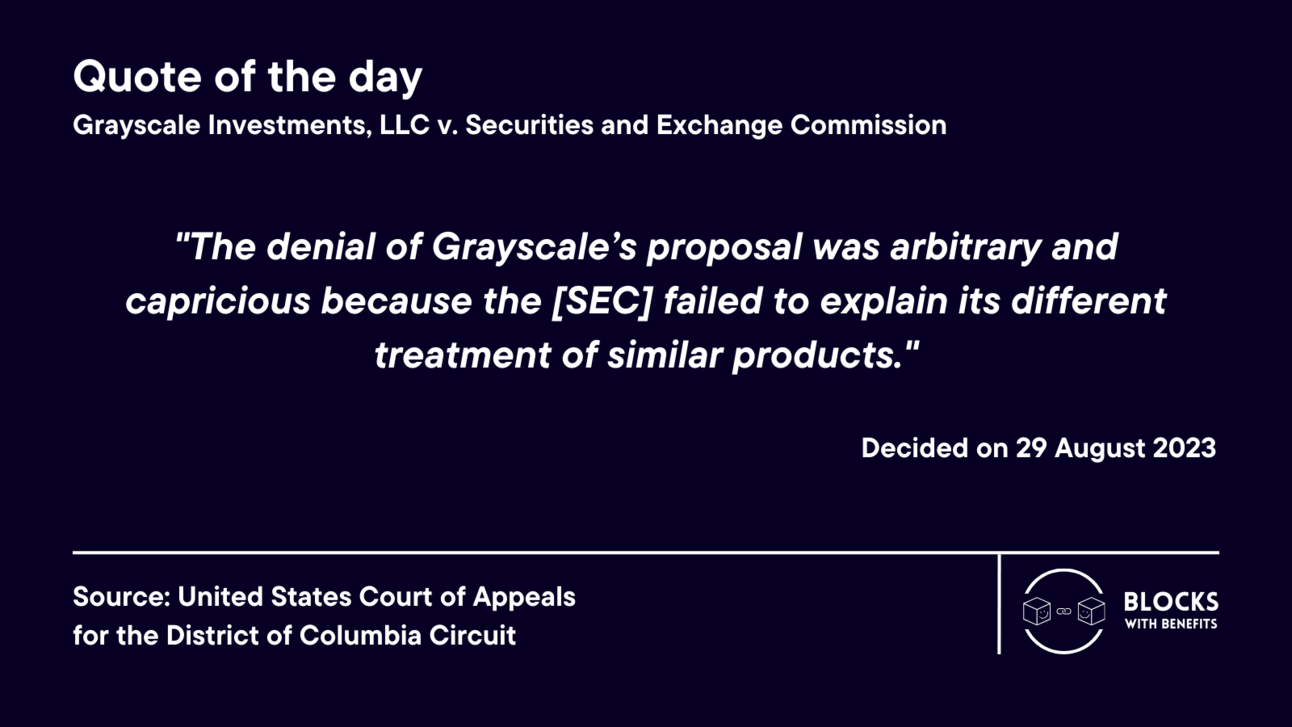

These characteristics have attracted asset managers for years. The SEC has rejected various ETF applications since 2013. The reason? ETF share prices could be vulnerable to market manipulation. In a nutshell, the SEC's view used to be that there is no reliable index to track the price of bitcoin.

In August 2023, however, a US court decided that the SEC had no reason to reject the ETF application from Grayscale Investments. That led to a rush of other applications from big players such as BlackRock – and ultimately to their approvals.

How does it work in practice?

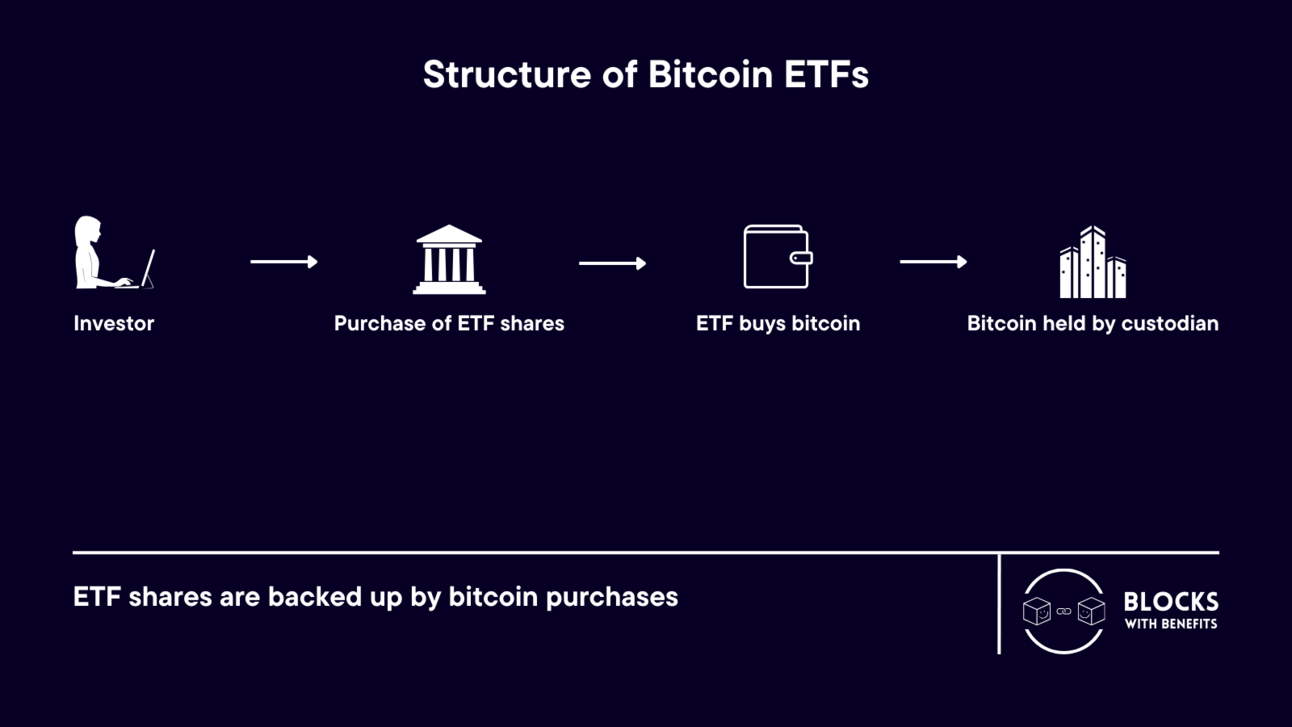

When you buy shares in an ETF, you can simply buy and sell these shares during regular trading hours and without significant costs. The ETF itself generally tracks a certain index – in this case an index for the bitcoin price.

The money which the new Bitcoin ETFs are generating by selling shares to investors will be invested into bitcoin. Bitcoin funds will be held by custodians such as Coinbase Global.

This means that there will likely be additional demand for bitcoin. As the supply of bitcoin is capped, the bitcoin price has surged in recent months. It is impossible to say how much of that is due to the anticipated increase in demand. Nevertheless, most analysts agree that this has definitely been a factor.

How much long-term demand the new ETFs will generate is just as hard to predict. For 2024, the Galaxy Digital estimate was slightly above $14 billion. Standard Chartered is a lot more optimistic, predicting inflows of $50 to $100 billion in 2024 alone.

We'll have to wait and see how this all plays out in reality. For the crypto industry as a whole, however, it is arguably even more important that the new ETFs boost the legitimacy of the sector.

Was that an interesting read? Feel free to subscribe so that you’ll get all of our content as soon as it’s ready. We’ll really try not to be boring.